What is a family office?

...and how rich do you have to be to own one? Forget the 1%, here’s what you need to know about the 0.1%.

👋🏼 everyone,

Unless you own one or have been exposed to one, the world of family offices is incredibly low-key which goes largely unnoticed.

Which is quite remarkable, given that family offices have become a major force in investing, managing between $4 trillion and $6 trillion in assets globally—roughly 5% of the total value of the world’s stock markets.

Money talks, wealth whispers - and these families are very quiet indeed.

Today I’m going to cover:

What even is a family office?

Family offices…in numbers

How rich do you need to be to own one? 🧐

How the super wealthy are allocating their assets

Famous families with family offices

Family Office feuds - why succession is important

p.s. if you want to grow your financial brain and build wealth, become a Finbrain member and get access to my Alternative Asset Guides, Stock Market Fundamentals Program, Investment Portfolio Case Studies and lots of investing resources

So, what is a family office?

The reason family offices seem so mysterious is simple: there’s no clear definition of what they actually are or what they do.

Actually, a family office is simply an investment management firm that exclusively serves one wealthy family, without taking on outside capital. Instead of managing their wealth themselves, the family hires professionals to handle all the work they’d rather avoid - no spreadsheets for these folks!

In some cases, accounting, wealth and lifestyle management services are also provided from the same office, such as upgrading their yacht 💅

Managing a mix of assets

Family offices deal with a wide variety of assets, from the usual things like stocks, bonds, and real estate to the more modern things like cryptocurrency.

But they don't stop there.

Some of them manage serious collections of art, antiques, or even big-ticket items like private jets, yachts, and diamonds. What's more, many family offices also focus on philanthropy, using their wealth to support causes they care about-whether that means preserving art, lending collections to museums, or establishing charitable foundations.

Family Office Stats 👩💻

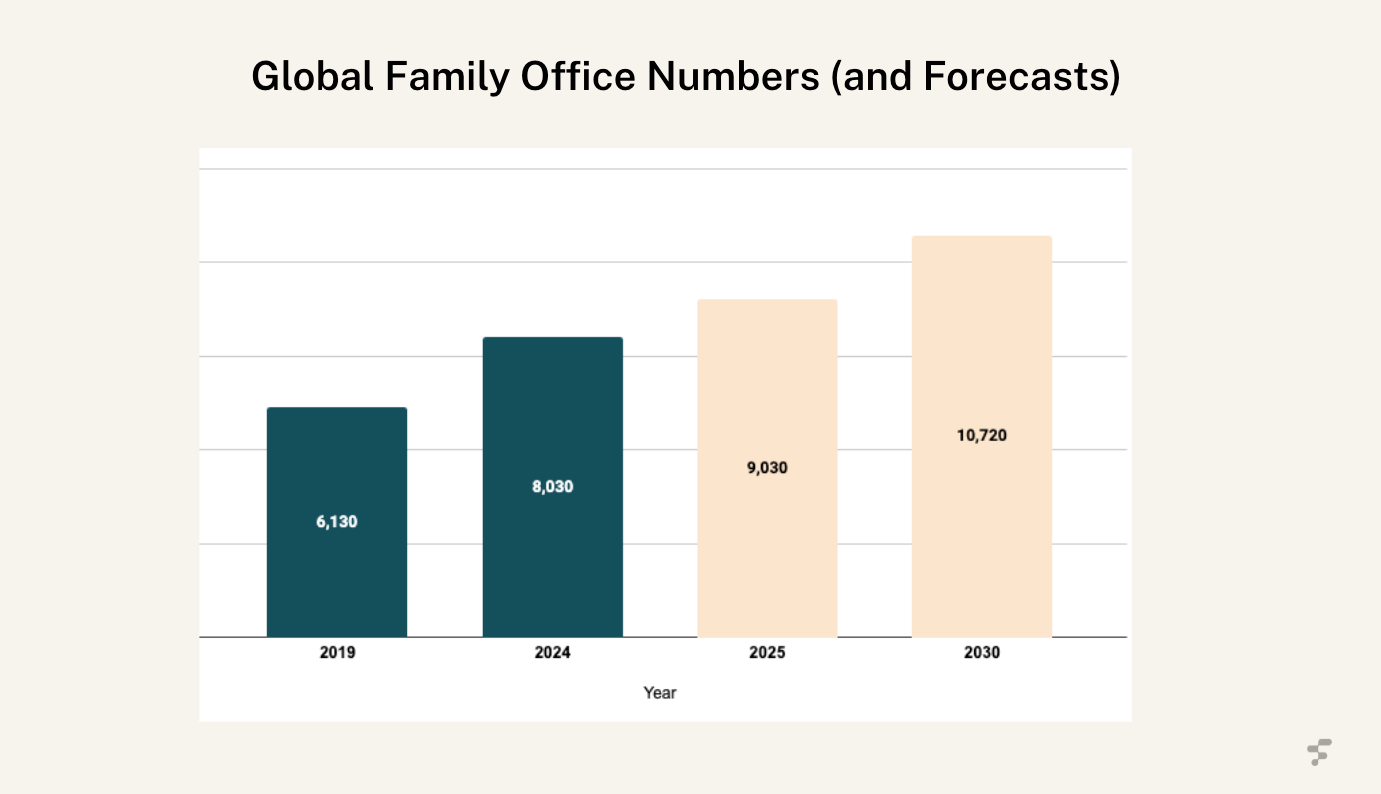

There are an estimated 8,030 single family offices in the world today, up from roughly 6,130 in 2019.

Family offices’ total estimated assets under management (AUM) are expected to rise 73% from US$3.1 trillion today to US$5.4 trillion by 2030.

The estimated wealth of families with family offices currently stands at US$5.5 trillion. This is up from US$3.3 trillion in 2019 and is expected to grow to US$9.5 trillion by 2030 – a 189% increase.

Women now serve as the principals of 15% of family offices worldwide, demonstrating an increase in women taking on greater leadership roles within family enterprises.

Family offices are about to surpass hedge funds, with $5.4 trillion in assets by 2030

How rich do you need to be to own one?

The general consensus is that a family office costs as much as you need it to.

In reality if your net worth is less than $50 million, then it might be a waste of your time.

Why?

Well if you just look at the average running costs, even for a small family office, then they’re not small sums:

How are family offices allocating their assets?

Even if you’re not working with millions, understanding how family offices invest is quite intriguing - especially since they typically aim for an 11% return. That’s higher than what most people target, and they do it by spreading their investments across a range of asset classes.

Let’s see what they’re up to…

The big take-away is that family offices invest a lot more in private assets and alternative investments compared to typical funds.

While most traditional funds only allocate around 15% to alternatives, family offices go for almost 40%, making their approach very different.

For example, family offices in Europe put an average of 22% of their money into private equity, an area that regular funds barely touch. They also invest in real estate (12%), hedge funds (4%), and private debt (3%).

Real estate, however, has seen a decline recently because of uncertainty around property values and a shift towards more liquid investments that generate steady income.

On the other hand, family offices allocate less to the stock market and bonds compared to traditional portfolios - only 28% in stocks and 16% in bonds, whereas typical funds hold about 55% in stocks and 30% in bonds. However, the bond allocation has been increasing, as more believe in the "higher for longer" trend, meaning interest rates might stay elevated.

(Data from UBDS Global Family Office Report 2024)

Famous Families with Family Offices 👀

When it comes to family offices, their investment strategies can be bold and unique -hence why you’ll see ‘space’ crop up a few times. Not an area you average investor is focussed on.

And keeping on the theme of secrecy, some don’t even have websites.

Elon Musk’s Family Office – Excession

Elon Musk’s family office, Excession, isn’t just about managing his money - it’s fuelling some of his boldest ventures. We’re talking about funding the next frontier with projects like SpaceX and Tesla, along with some cutting-edge AI developments.

Musk’s big dream is to push the limits of space travel and artificial intelligence, and Excession plays a huge role in making those visions come to life.

The Bezos Family Office – Bezos Expeditions

When Jeff Bezos isn't focused on Amazon, his family office, Bezos Expeditions, is exploring new horizons.

Literally.

He’s all in on space exploration with Blue Origin, his own space company. And it’s not just rockets, Bezos Expeditions is also big on tech and e-commerce investments.

Jay-Z’s Family Office – Marcy Venture Partners

Jay-Z didn’t stop at music - he built a business empire through Marcy Venture Partners, his family office. He’s got his eye on consumer goods, entertainment, and startups that shake things up. From Uber to Savage X Fenty (Rihanna’s lingerie line) and Oatly, Jay-Z’s investing in brands that connect with culture. Plus, he’s got a piece of the music world with Tidal, his streaming service.

Family Office Feuds - Why Succession Is Important

Let’s take the Koch family as an example - they’re one of the wealthiest in the world, and have seen its fair share of internal disputes, especially when it comes to their family office and control of the family fortune.

Charles and David Koch took the reins of Koch Industries after their father’s passing, but things didn’t go smoothly with their brothers, Bill and Frederick. Tensions built up as Bill and Frederick felt pushed out of key decisions, leading to a nasty legal battle in the 1980s.

The main issue?

Control of ownership shares and how the family’s business should be run, with both sides fighting for influence.

At the heart of the drama was the family office, which was in charge of managing the Koch wealth and deciding how to invest and grow it.

The office’s role in structuring equity and settling disputes made it a focal point in the brothers' fallout.

Eventually, a deal was struck, with Bill and Frederick selling their stakes, but the damage was done.

The whole saga highlights how important family governance and a solid succession plan are when managing a vast fortune. It’s also a reminder that family feuds can do more than just strain relationships, they can shape the entire future of a family empire - if you’ve got one that is.

Hope this was a fun insight into the often bizarre world of family offices.

Thanks for reading as always. And if you enjoyed this week’s post, hit the ❤️ like button below!

Jason

DISCLAIMER: None of this is financial advice. Concepts of Finance newsletter is strictly for educational purposes.

Nice blog really interesting hope to have a family office for my family one day !! 💪🏻🔥

Thank you, Jason!

While we may not call it a family office but at the moment we are managing our family fund ourselves.

Even if you don't have billions, just by pooling your money you open up a range of opportunities that wouldn't be available to each family member individually. Furthermore, the next generation learns how the fund works so can gradually more into the decision making processes. At current growth rate it is foreseeable that we will need to look for support staff in the not too distant future.

We totally agree that governance and succession planning are key. It should also be perfectly acceptable if a family member doesn't want to participate (any more).