Market Cap vs. Equal Weighted Index Funds - Explained

The differences and the pros and cons of equal-weight indices vs traditional market-capitalisation-weighted

👋🏼 everyone,

Hope you’re all having a good week.

At the time of writing this, the S&P 500 ($SPX) is up +24.2% year-over-year.

And when you look at the equal weighting performance of the S&P 500, then it’s up +11%.

However, it dawned on me as I was checking these figures that even if you want to stick to a simple strategy like passively buying an S&P 500 index fund, then you’ll still be confronted with some options because there’s more than one way to invest:

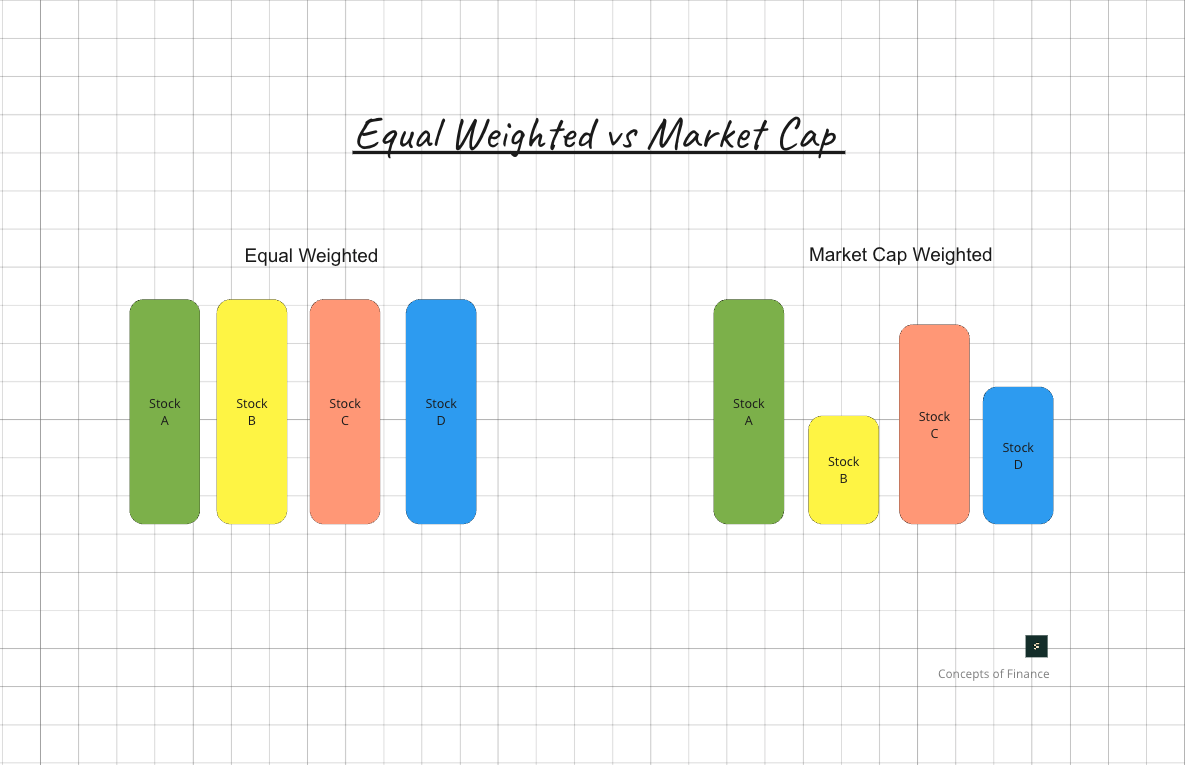

The market-cap-weighted S&P 500 (which is the default for ETFs like VUSA or VOO)

The equal weight S&P 500 (which is what some people recommend)

So with that said, let’s dig a bit deeper.

Today’s talking points:

Market cap and equal weighted, quickly explained

Potential upsides and downsides of both options

But doesn’t market-cap always outperform? (short answer, no)

Where you can find the weighting information for a index fund