Investment Portfolio Strategies - A Beginner's Guide (Part 1)

Why having an investment strategy matters and proven frameworks for success

Someone's sitting in the shade today because someone planted a tree a long time ago

Warren Buffet

👋🏼 everyone,

First off, apologies for the long pause between newsletters. It’s been a while.

Since I last posted, I've seen two wonderful friends get married, worked on a new product (which I'm super excited to share more about in the coming weeks!), but most happily, I became a first-time uncle to a beautiful little niece.

But now, I'd like to get back to business and why I started this newsletter in the first place - to breakdown complicated financial concepts into plain English and provide practical information to help you make better decisions, build wealth and grow your financial brain.

And with that, what better way to get back into the swing of things than to tackle a very important topic - investment portfolio strategies - what they are, why you should care about them and why having the right one can make all the difference to your financial future.

Let’s get to it.

Today I am going to cover:

🧐 What exactly is an investment strategy, and why should you have one?

Key questions to reflect on when building your investment strategy

Different approaches: example investment portfolio strategies

💼 A real-world insight: take a look at a Google Software Engineer’s investment portfolio

Helpful tools and resources 🧰

PS. as I was writing this this I realized we probably need two parts to this since there’s lots to cover. This is Part 1 and Part 2 (next week) will focus on the practical steps of building your first investment portfolio.

If you want to grow your financial brain and build wealth, become a Finbrain member and get access to my Alternative Asset Guides, Stock Market Fundamentals Program, Investment Portfolio Case Studies and lots of investing resources

(Quickly) Explained…

All over social media, we see statements like, “Invest in X, it’s gone up by 200% in the last 3 years” or “Buy this Index Fund, and you can’t go wrong”

This, however is where an investment strategy comes into play - what’s right for someone else, may not be right for you.

An investment strategy is basically a game plan to help you reach your financial goals.

It shapes how you make decisions, considering things like your goals, risk tolerance, and future cash needs. Some strategies play it safe, focusing on protecting your money, while others go for aggressive growth, aiming for bigger returns by taking more risks.

Why do you need one? A lesson from my own misfortune…

Unfortunately, a mistake I made in the past is a good case in point.

In 2014, I bought a pretty decent chunk of Amazon stock. It was my first real foray into investing. I didn't have any clear goals, I was on an emotional rollercoaster every time there was a slight dip or new high, and I didn't really have a solid emergency fund at the time.

Fast forward 18 months later, I sold the stock when it was priced ~$27. As I write this, Amazon (AMZN) is trading at $193. An increase of over 600% 🫣

Why am I telling you this?

Because I'm pretty sure I would have held on to my Amazon shares if I'd had a clear investment strategy and goals at the time.

One of the biggest challenges investors face is letting emotions drive their decisions, especially during times of market volatility. It's easy to panic when things look uncertain, but a solid investment strategy can help keep those emotions in check.

With a clear plan, you're less likely to make impulsive decisions that could hurt your portfolio in the long run.

Having a strategy also means you’re working towards specific long-term goals. Whether you're saving for retirement or building wealth for your family, knowing what you're aiming for keeps you focused and motivated. Sticking to your plan provides consistency, no matter how unpredictable the market may seem, helping you stay on course without being swayed by short-term trends.

By following a well-thought-out investment strategy, you can also minimize risk. Diversifying your investments across different assets reduces the chances of a major loss, giving you peace of mind. With a solid plan in place, you're less likely to worry about market swings and more confident in your financial future.

And I say this as someone who’s learned the hard way!

Investment Portfolio Strategies - Common Examples

Building the perfect investment portfolio is always a hot topic amongst investors, and with so many options - stocks, bonds, real estate, and more, it can (and almost certainly will the first time round) feel overwhelming to figure out where to put your money.

Some folks keep it simple, while others embrace more complex strategies, making it hard to know which path to follow.

The truth is, there's no one-size-fits-all approach, but a few popular strategies have gained traction for their ability to diversify across different asset classes without being overly complicated or expensive.

Whether you're just starting out or already experienced, understanding these 3 common portfolio strategies can help you fine-tune your own investment strategy.

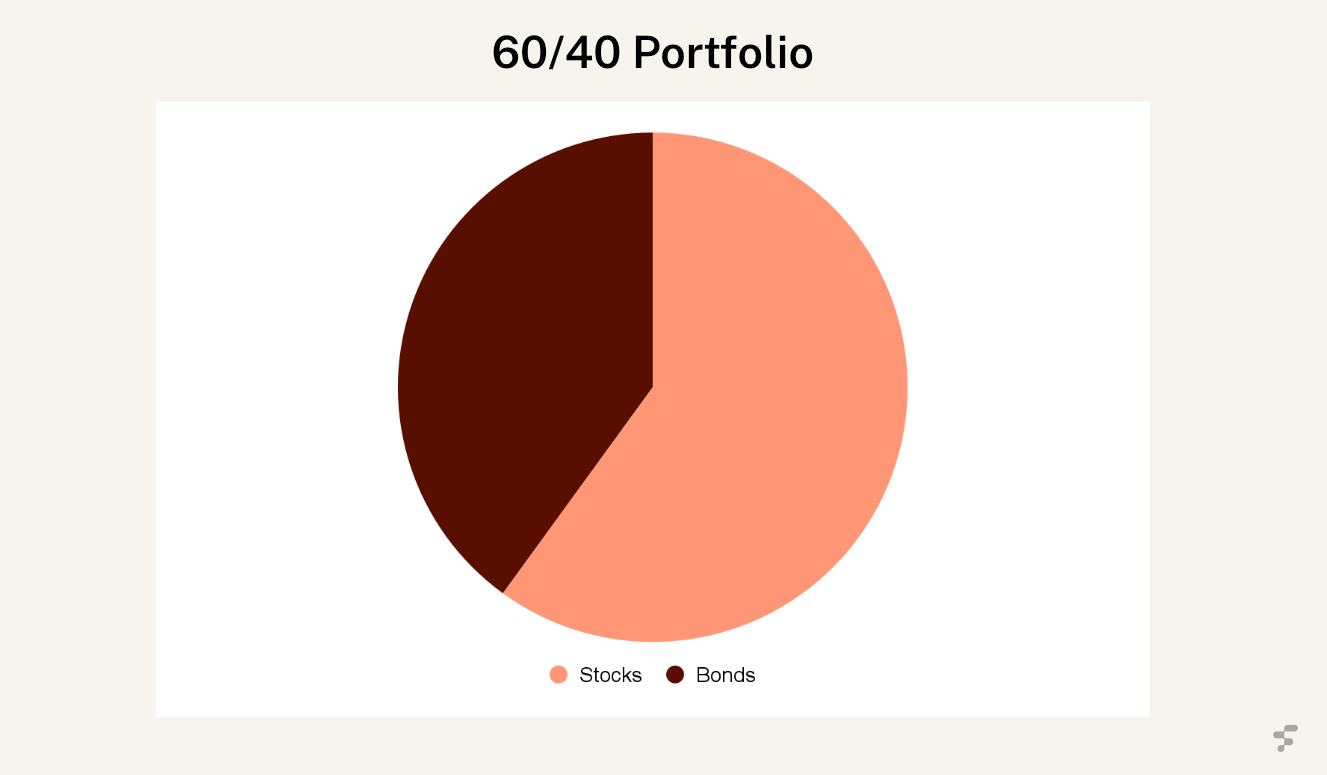

60/40 ⚖️

So first up is the the 60/40 portfolio, a classic investment strategy that splits 60% into stocks for growth and 40% into bonds for stability. It’s designed to balance risk and reward, making it a popular choice for long-term investors.

Upsides 😀

Balanced risk: the mix of stocks and bonds helps reduce overall volatility, making it less risky than an all-stock portfolio.

Growth potential: with 60% in stocks, you still have significant growth potential over the long term.

Income stability: the 40% in bonds provides steady income, which can be comforting during market downturns.

🙃 Downsides of the 60/40 Portfolio

Limited upside: in a booming market, this strategy may not perform as well as a higher stock allocation.

Interest rate sensitivity: bond prices can fall when interest rates rise, potentially hurting your portfolio’s performance.

Inflation risk: The fixed income from bonds might not keep pace with inflation over time, eroding your purchasing power.

Historical Performance (1985 - 2024):

Average annual return: ~8%

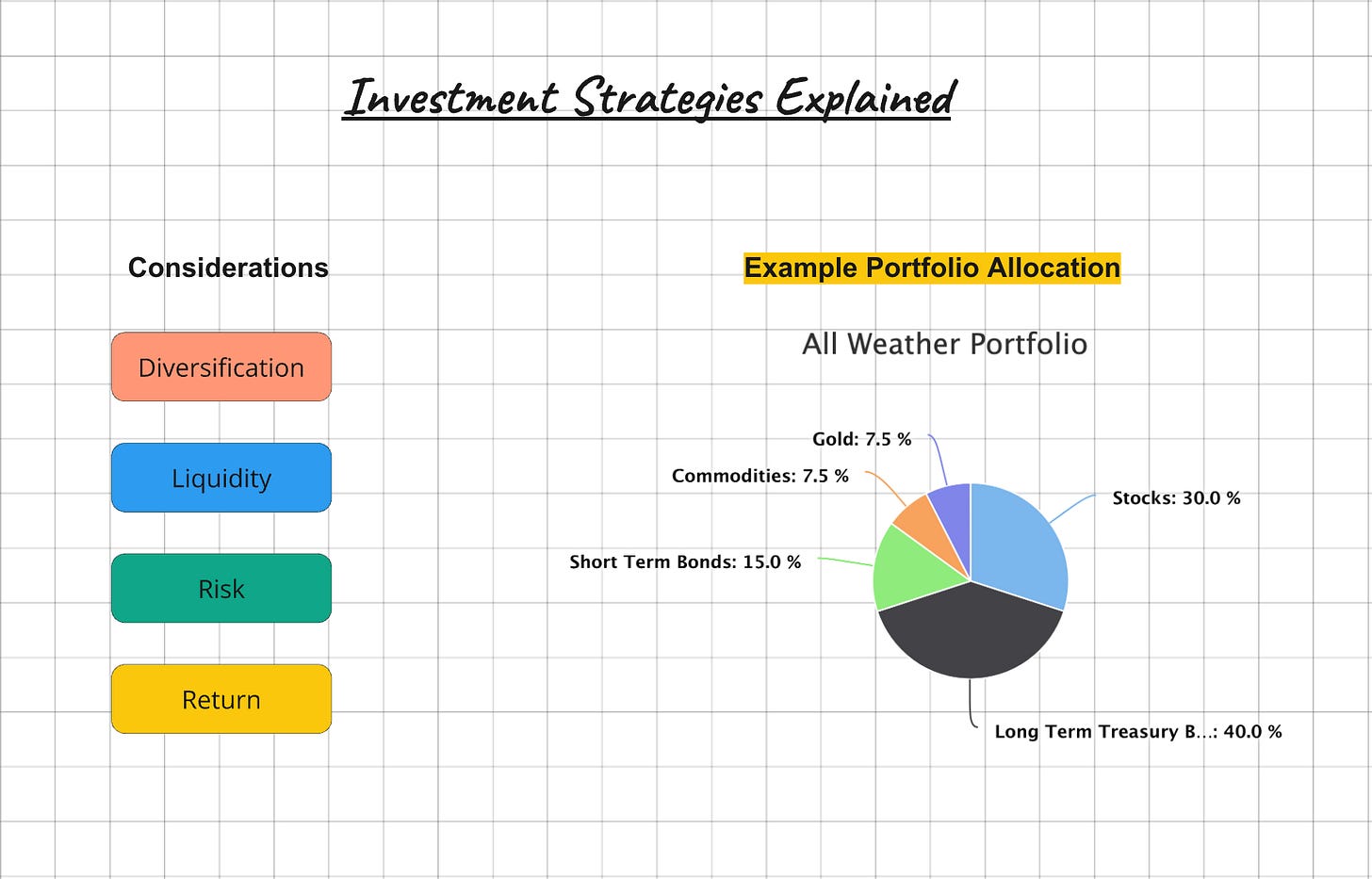

All Weather Portfolio ☔️ ☀️

Not every investment portfolio performs equally well in all economic conditions, so if you're looking for something more stable, Ray Dalio's "All Weather" portfolio might be worth considering. This strategy aims to balance risk and reward by preparing for different economic scenarios, even if it means giving up some potential returns.

Dalio developed this strategy by analyzing two key economic factors: inflation and economic growth. He identified four economic environments that we cycle through, and to create a resilient portfolio, he included a mix of stocks, bonds, commodities, and gold. Each of these investments thrives in different conditions, so when one is struggling, another is likely doing well, helping to smooth out the ups and downs and protect your overall investment.

Upsides 😀

Stability in all conditions: this portfolio is built to handle different economic situations, which means it can help cushion you from market ups and downs.

Diversification: by mixing stocks, bonds, commodities, and gold, it spreads your risk around, which can protect your investments if one area takes a hit.

Passive management: once you’ve set it up, it’s pretty low maintenance, so you won’t have to constantly adjust it like with some more active strategies.

Downsides 🤔

Potentially lower returns: Since it focuses on stability, you might not see the same big returns as you would with a riskier all-stock approach.

Complexity: the mix of different investments can be a bit overwhelming for beginners who might not be familiar with each one.

Cost of ETFs: if you’re using exchange-traded funds (ETFs) to build this portfolio, watch out for fees—they can add up and eat into your returns over time.

Historical Performance (2005 - 2024)

Average annual return: ~7%

Three-Fund Portfolio

A three-fund portfolio is a simple investment strategy where you hold mutual funds or ETFs that focus on U.S. stocks, international stocks, and bonds. This approach is really about keeping investing straightforward and minimizing costs.

Upsides 😀

Simplicity: it’s super easy to manage since you only have to keep track of three funds. No complicated setups here!

Diversification: by investing in 🇺🇸 stocks, international stocks, and bonds, you spread out your risk, which can help protect your money if one area takes a hit.

Low costs: most index funds have lower fees than actively managed ones, so more of your money stays invested and working for you.

Downsides 🙃

Limited customization: with just three funds, you might miss out on some specific sectors or investments that could really boost your returns.

Market dependence: Your portfolio’s performance will closely follow the market, so if things go south, your investments will feel the impact too.

Potentially lower returns: while it’s a stable approach, you might not see the same big gains as you would with more aggressive strategies focused solely on stocks.

Historical Performance (2009 - 2024)

Average annual return: ~11.2%

Questions to ask yourself before you invest… 💭

Before defining an investment strategy, it's important to consider a few critical questions. The following is not exhaustive, but pondering questions like this in advance will help when forming your strategy.

How much emergency savings do you have set aside, and what amount would make you feel comfortable?

What future bills or major expenses do you anticipate in the next 1-2 years, and how are you preparing to cover them?

What portion of your funds could you afford to lose entirely, and how does that impact your willingness to take on high-risk investments?

Do you believe in trying to time the market, or do you prefer a long-term approach when investing in stocks?

When it comes to publicly traded stocks, do you focus on index funds, or are you drawn to more active strategies like stock picking?

How are you managing geographic risk in your portfolio? Are you diversifying outside of your home market, and how do you balance that with the performance of local markets?

How much do you want to invest in stock vs bonds vs gold etc

Helpful tools 🔍

The Vanguard Quiz tool is useful also to help shape your thinking - the questionnaire suggests an asset allocation based on information you enter about your investment objectives and experience, time horizon, risk tolerance, and financial situation.

⚠️ Working out your risk tolerance can be super hard - this investment risk tolerance questionnaire helps a little, at least gets you thinking by the questions that are posed.

A case study…

To bring this to life a little, let’s use a real world example - Justin is a Software Engineer at Google. He earns a (very) healthy salary of $300k and his expenses are about $72k per annum.

Justin’s investment philosophy in his own words:

I want to be as risky as I can while still being able to sleep at night. I also don't want to obsess about money to the point where I'm stressed if a huge market downturn happens.

My long term goals are to diversify and move some of my assets into real estate. So, I’m trying to construct my portfolio such that it will likely hold value reasonably well in a market downturn and also grow as markets recover.

Regarding real estate, as I said, I want to get more exposure to that asset class, so I’m building a pretty large cash position that will go towards a down payment.

His current portfolio breakdown (more info here):

🧰 Tools + Resources

Backtest a portfolio: this tool lets you build and test different investment portfolios using mutual funds, ETFs, and stocks. You can see how each portfolio performs over time, including returns, risks, and how different factors affect them. It also breaks down the performance and risk of each asset in your portfolio.

Investor Questionnaire: a quiz that suggests an asset allocation based on information you enter about your investment objectives and experience, time horizon, risk tolerance, and financial situation.

Portfolio Models - a great source using clear data to help DIY investors find a portfolio that works for them

I hope this has been helpful so far. Next week, in part 2, I’ll be focussing on how to create your investment strategy/plan.

Till then 👋🏼

Jason

DISCLAIMER: None of this is financial advice. Concepts of Finance newsletter is strictly for educational purposes.

I think the All Weather would be stronger if half the long duration bond allocation were switched to liquid alts like trend following ETFs. I think all-weather will beat 60/40 over the next decade, with less volatility.

haha I love that AMZN story. We all have those stories, and they teach us a lot! Part of the investment plan as a passive investor is to understand you need to let those passive positions work over much longer periods of time. As the old saying goes, compounding is the 8th wonder of the world!