Investment Opportunity Guide: Wine

The pros and cons of investing in fine wine: a practical guide

Finbrain Pro members get access to the full library of investment opportunity guides, stock market fundamentals course, investment portfolios, plus the new complete financial tracker for tracking your investments, spending, net worth and more.

Hey 👋🏼,

OK, so this is an investment guide near to my heart/mouth, as my drink of choice is a medium bodied, ripe Sangiovese red wine. I’ve never really considered myself a wine connoisseur but since last summer where I attended a friend’s wedding in Tuscany, I've become more interested in understanding a bit more about it.

But my drinking habits to one side, wine as an investment asset has really gained momentum over the last decade or so..

So let’s uncover how it all works.

I’m going to cover:

Why invest in wine 🫣

The wine market in numbers 🔢

How to invest in wine 💻

Wine bottles

Wine futures

Wine stocks

Wine investment platforms

Why should you invest in wine?

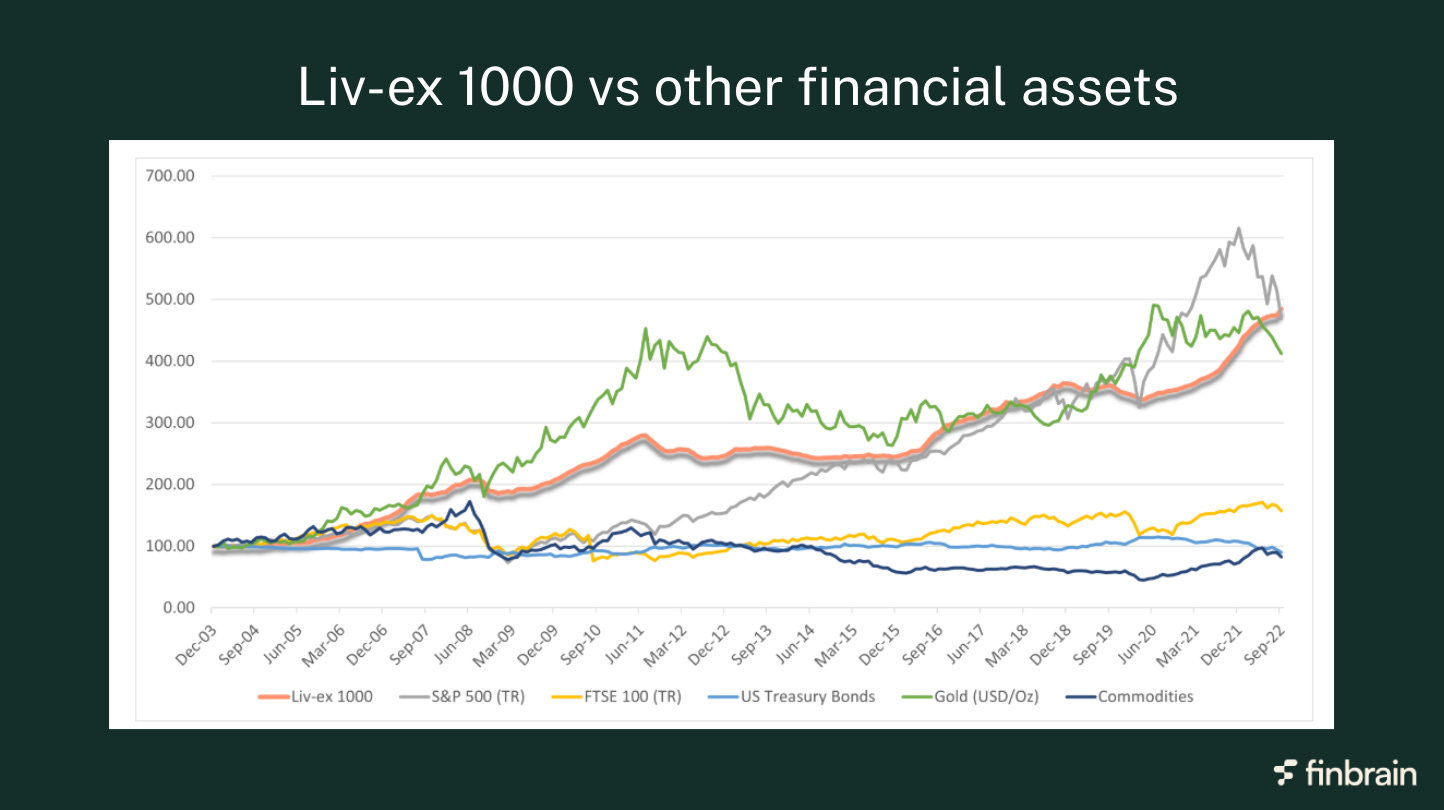

Investing in fine wine is gaining traction as a serious alternative asset class due to its consistent returns and low volatility compared to traditional investments like stocks and real estate. For instance, in 2023, the fine wine market saw a 20.54% increase, surpassing gold's modest 1.55% return during the same period.

This growth is driven by the limited supply of high-quality wine and the growing global demand, particularly from emerging markets like Asia and Latin America.

The wine market in numbers

The wine investment market in 2024 started to show signs of stabilization and possible recovery after a period of correction.

Over the last 12-18 months, wine prices dropped by about 20%, which is creating a good opportunity for investors looking to get in.

Recent data suggests that the market may be hitting its bottom, with more trading activity and slower price declines across different regions. Prior to this bumpy time for wine, the longer-term historical view has been a largely positive story…

The Liv-ex 100, which tracks the most traded fine wines globally, has performed well, with an 8% year-on-year growth rate as of 2024. Regional trends are mixed - Burgundy and Rhône have remained fairly strong, with slight declines of just -1.03% and -0.89% respectively in Q3 2024. On the other hand, Bordeaux has faced more challenges, with a -4.40% drop in the same period. Italy has been one of the more stable regions, with the Liv-ex Italy 100 benchmark showing a -2.1% decline in H1 2024, outperforming the broader Liv-ex 1000 (-6.3%).

Looking ahead, the wine investment scene presents potential for long-term investors.

With interest rates expected to decrease and wine prices showing signs of stabilization, the market could be primed for growth…

How to invest in wine

This is what you’ll unlock as a Pro member:

💰 40+ (and growing!) investment opportunity guides to explore diverse opportunities for wealth creation.

📊 The Ultimate Financial Tracker to track your investments (with auto-updates!), keep an eye on your savings and net worth, monitor your monthly budget and see exactly what you need to achieve financial independence and how far you are from it!

🎓 Stock market fundamentals course that gives you the skills and knowledge to invest with confidence

📒 Investment strategies from real investors to help craft your own successful investment approach

🧰 Investment resources and tools that elevate your investment game

And since FinBrain Pro gives you lifetime access, you’ll keep getting new tools and resources as they’re added - no extra cost.

DISCLAIMER: None of this is financial advice. Finbrain is strictly for educational purposes.

I just wish CWGL reflected the wine index.