Index Funds: Everything you need to know

What are they, what are the potential upsides and downsides vs other forms of investment?

👋 everyone,

It’s been over 45 years since the world’s first index fund was made available to individual investors and these days, index funds hold trillions of dollars in value.

My first exposure to index funds was over a coffee with an old boss of mine years ago. As a newbie to the world of investing, I explained that I wasn’t sure whether to pick company stock A or company stock B. They explained that you don’t always have to pick and choose stocks thanks to investment types like index funds (which was news to me!).

And this is one of the reasons index funds are so popular today; they can be a great entry point for folks with little experience as they’re designed to help you de-risk your portfolio and (hopefully) see returns on your investment over time at a higher rate than a typical savings account.

So what are index funds and what are some of the key things you should know about them?

Coming up in today’s newsletter:

What are index funds?

How do they compare against other types of investments?

📹explanation

Examples of common index funds

Key terminology

Useful tools

Note: As always, this is not financial advice - just purely for educational purposes 🙏.

p.s. if you want to grow your financial brain and build wealth, become a Finbrain member and get access to my Alternative Asset Guides, Stock Market Fundamentals Program, Investment Portfolio Case Studies and lots of investing resources

Quickly explained

An index fund is a type of fund that aims to replicate the performance of a specific market index. When we talk about market indexes, this refers to a statistical measure of the performance of a specific group of stocks or an overall financial market.

Some examples of market indexes you’ve probably heard of would be:

🇺🇸Dow Jones Industrial Average - Index of 30 large US publicly traded companies that aims to be a broad representation of the overall US stock market.

🇺🇸NASDAQ Composite - Index of over 3,000 stocks listed on the NASDAQ exchange, heavily weighted towards tech companies.

🇬🇧FTSE 100 - Index of the 100 most highly capitalized companies listed on the London Stock Exchange.

🇯🇵Nikkei 225 - Index of 225 top companies listed on the Tokyo Stock Exchange, representing major sectors of the Japanese economy.

Index funds work by purchasing all or a representative sample of the securities included in the index they are tracking. For example, an S&P 500 index fund would buy shares of all 500 companies in that index, holding them in the same proportions as the index itself. The fund's performance then mirrors any rises or falls in the overall index.

Index funds offer broad market exposure at low cost compared to actively managed funds, as there are fewer research and trading expenses involved in passive management. They are less volatile than investing in individual stocks - and that comes with both benefits and downsides, as you can imagine.

In addition to these broader index funds, there are now a bunch more specialized indexes focusing on market sectors, factors, investment styles, and asset classes like commodities and real estate.

How do index funds compare against other types of investments?

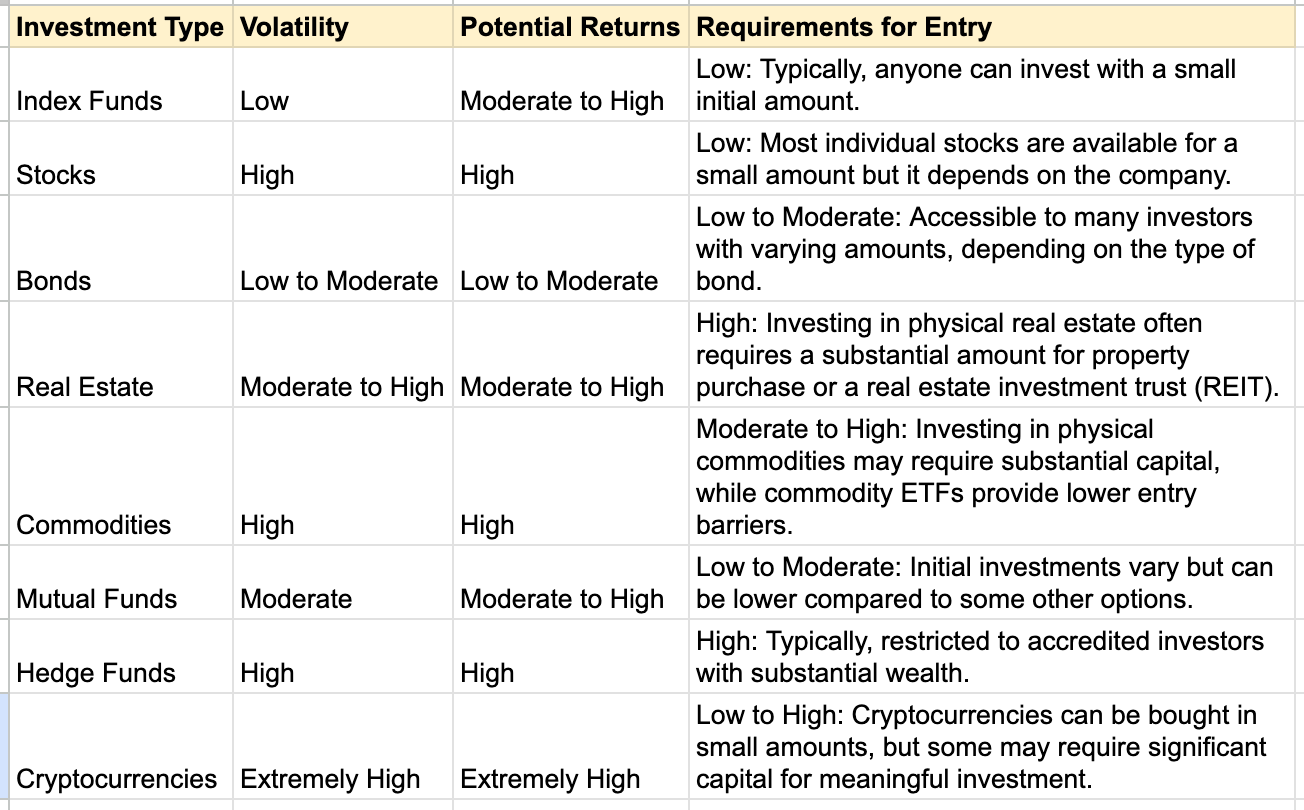

Here’s a summary of how index funds compare against other types of investments including: stocks, bonds, real estate, commodities and crypto.

As always, these are just for illustrative purposes and doing your own research is essential but hopefully it gives you a flavor of how each investment type compares:

In comparison to other investment types, index funds are classed as lower volatility with moderate to high returns.

ETFs vs Index funds: what’s the difference?

Index funds are very similar to ETFs; they both essentially have the same underlying investment strategy underpinning them, but there are some differences between the two. I don’t think these differences are that significant but they’re worth knowing nonetheless.

To help put this into context, let’s take a step back to understand some of the key concepts associated with actively managed funds and passively managed funds:

Index funds and ETFs are passively managed investments which means they are merely tracking the performance of a particular index.

Nobody is working on your behalf to try to beat the market. An actively managed investment fund would include an investment professional who could hand pick stocks for the fund based on what they believe the performance is likely to be. The ironic thing here is that often, index funds outperform actively managed funds - but no one will tell you that!

Some of the main differences between ETFs and index funds are:

Fluctuations: Index funds can only be bought or sold at the end of the trading day - the price doesn’t fluctuate throughout. ETFs are traded more like stocks which reflect the price of a stock at a given point in time. An ETF investment at 9am could look very different from an ETF investment at 3pm.

Barrier to entry: Index funds sometimes require a minimum investment amount. These aren’t huge but an ETF can be purchased as a single stock representing the fund.

Automatic contributions: Index fund investors will often commit to automatic contributions to make investing easier over time. Some ETF providers will also do this too but it’s very common with index funds.

Index funds explained in 36 seconds

How can you invest in an index fund?

There are many ways to get started with index funds and one of the most popular companies that offers them is Vanguard. In fact, the founder of Vanguard was the creator of the first index fund back in 1975 which is part of the reason they have such a strong reputation.

The barriers to entry are low for the average investor which makes them a great option for folks who don’t necessarily work in the finance sector. To get started you’d just need to open a brokerage account and choose which index to invest in.

An example

To bring it all to life, let’s look at an example together.

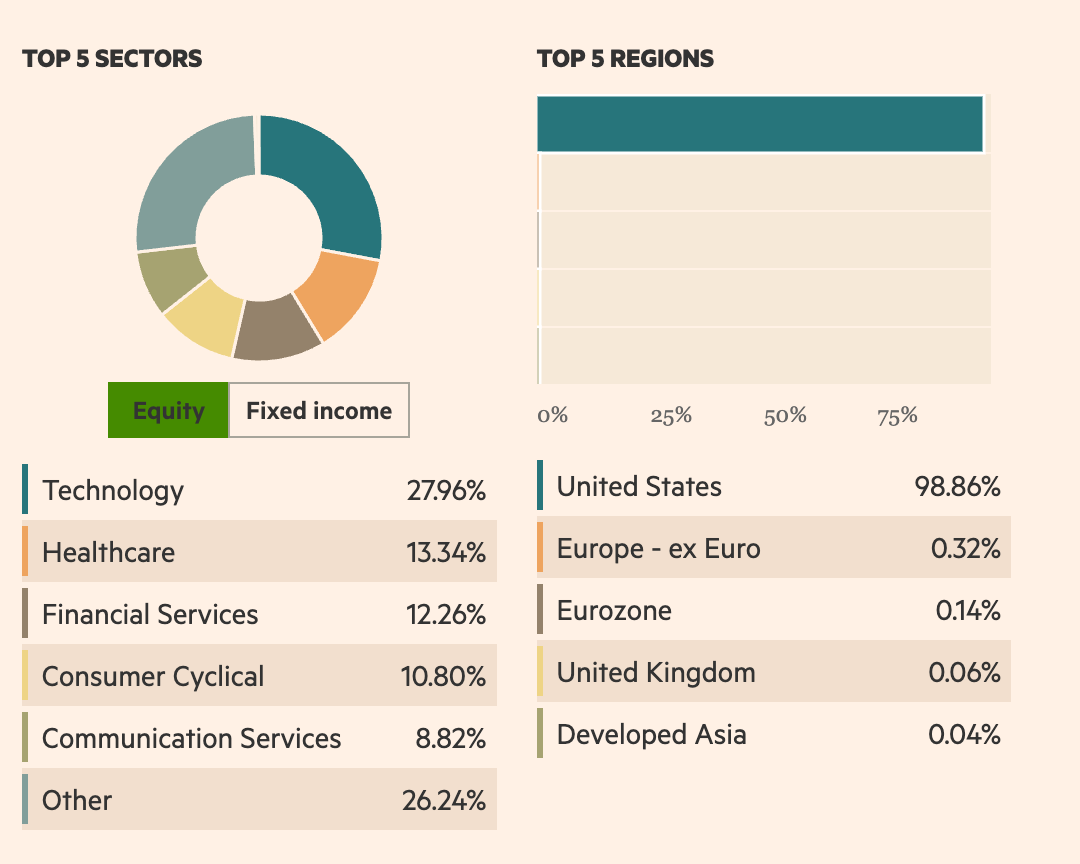

This is a snapshot of the Vanguard 500 Index Fund. This fund tracks the S&P 500 (the top US companies) and you can see that the performance of the fund over the past 5 years has performed pretty well - barring the last year or so!

Before you invest in an index fund, brokerage firms will explain exactly what the fund comprises of.

For this fund, for example, it will show you the top sectors that are included, along with the top companies and regions. Remember that this is a passive investment, meaning that all you’re doing here is investing in the market as a whole and not picking individual stocks.

Some see this investment strategy as a little dull compared to, say, investing in a company like Apple back in 2003 where your gains would be huge. But for every Apple, there’s a WeWork. And that’s the beauty of investments like Index Funds and ETFs; they’re less stressful, and whilst they don’t always go up (as you can see in the past 2 years), they are generally perceived to be as less risky and less time intensive.

As the wise Warren Buffet once said:

By periodically investing in an index fund, for example, the know-nothing investor can actually out-perform most investment professionals.

Key terminology

Index - The underlying market index that an index fund is designed to track and replicate. Common indexes include the S&P 500, Dow Jones, and Russell 2000.

Weighting - Refers to the percentage of an index fund's portfolio allocated to each security in the index it tracks. Weighting schemes include market-cap weighting, equal weighting, and fundamental weighting.

Rebalancing - The process of adjusting an index fund's holdings to match the new weights of securities in the underlying index. Done periodically or when index components change.

Net Asset Value (NAV) - The per share dollar value of an index fund based on the total value of its underlying holdings. Reported daily after market close.

Expense Ratio - Annual fee expressed as a percentage charged to cover an index fund's management expenses. Vital to keep low for index funds.

Passive investing - Index fund strategy of tracking rather than actively picking investments, aiming to minimize costs and match market returns.

🛠️Useful tools and resources

Index funds vs ETFs: a primer by YouTuber Nischa

A list of major indexes from Investing.com

Thank you very much for reading 🙏 if you found this helpful and enjoyed the post, I’d be super grateful if you could hit the ❤️ below - thank you!

DISCLAIMER: None of this is financial advice. Concepts of Finance newsletter is strictly for educational purposes.