Hey all,

In the first ever edition of Concepts of Finance 🧠, I tackled one of the fundamentals of finance, inflation. I’m going to continue with that theme and this week we’re breaking down compound interest.

Enjoy!

(Quickly) explained…

What is it?

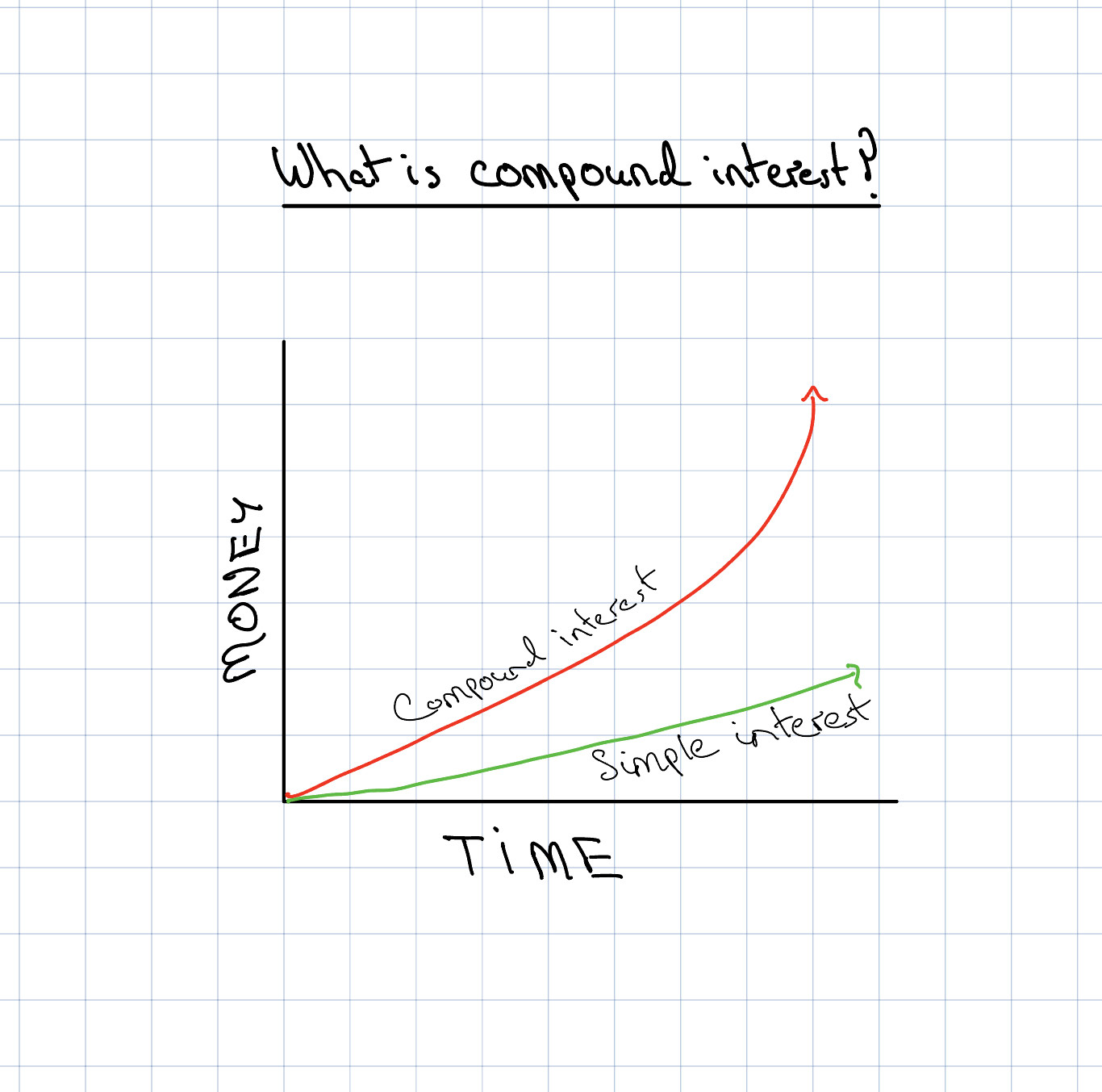

Compound interest is when you earn interest on both the money you've saved and the interest you earn.

This means that your money grows faster than with simple interest, where you only get paid back what you put in the first time. Think of compound interest like a snowball - as it rolls down a hill, it gets bigger and bigger and bigger. That's what compound interest does!

👀 Why does it matter to me?

Because it can help you make money!

For example, if you have $5,000 and you put it in a savings account that pays 5% interest per year, compounded annually, you'd have a balance of $5,250 after one year.

At the end of the first year, you would have earned $250 in interest ($5,000 x 0.05), so your balance would be $5,250.

In the second year, you would earn interest on the new balance of $5,250. So you would earn $262.50 ($5,250 x 0.05) in interest. Your balance would then be $5,512.50.

And so on, each year your interest would be calculated on the new, higher balance, resulting in an ever-increasing balance.

This is the power of the compound interest effect. 💪🏽

Terminology you’ll want to know 👩🏽🏫

Principle: This is the amount originally deposited in a compounding environment, such as a high-interest savings account at a bank. It is the initial amount on which the first interest payment is calculated.

Interest rate: the rate paid on the account value. The interest payment is equal to the interest rate multiplied by the account value (which is the sum of the original principal and any interest paid to date).

Compounding frequency: this determines how many times a year the interest is paid. It will affect the interest rate itself, as high-frequency compounding is usually only available on lower interest rates. Typically, compounding is done on a monthly, quarterly or annual basis.

Time horizon: refers to the period of time over which the compounding mechanism can work. The longer the time horizon, the more interest payments can be made and the higher the final account value will be.

Where can you look to find the compound interest rates?

You have a few options if you're looking for information on compound interest.

Banks and credit unions that offer savings or investment products. You can find out what rate they offer by checking their website.

Use an online calculator (see below). They can help you calculate the compound interest rate based on the amount of money you're saving or investing and how long you plan to save it for.

Official government sources e.g. if you're in the US, you can check the Federal Reserve website for interest rates and in the UK, the Bank of England.

You may also be thinking about investing in a particular product (savings accounts, bonds, investment funds, etc.) and you can find out the interest rate offered by the issuing institution.

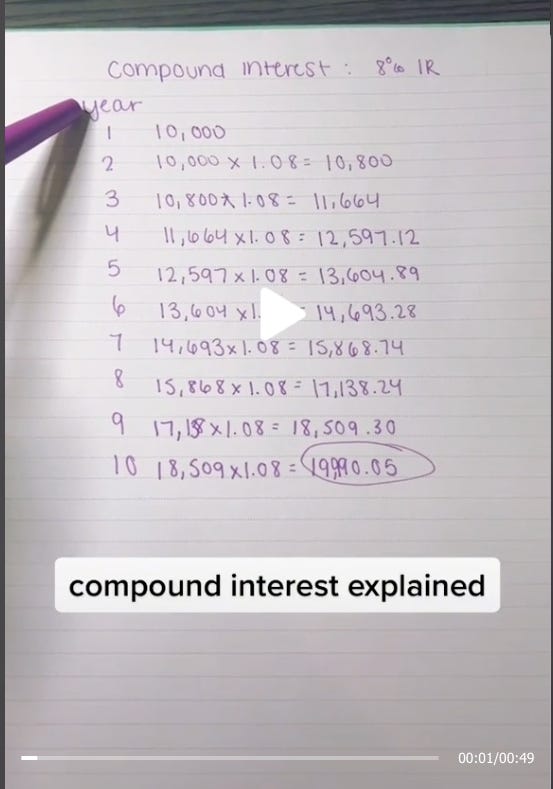

Compound interest…in 0:49 seconds!

Tools 🧰 🧑🏻💻

I love this tool from moneygeek, which allows you to (nicely!) visualise your savings or spending through compound interest.

As always, if you have any thoughts, reply to this email directly or drop me a note on jason.leonard@finday.io