5 Practical Ways AI Can Help You Invest Smarter and Save More

You probably use AI in many areas of your life, but what about your finances?

👋🏼 ,

Happy New Year!

AI is everywhere. We’re all painfully aware of that, I know. I’ve spent the past 12 years working in finance / technology and I’m just starting to see the potential dramatic impact AI might have on my industry.

But ask yourself this: have you considered how you use AI in the context of your finances?

Most folks I talk to pause to think when I ask this.

They recognize AI’s role in countless areas of their lives but realize they’ve yet to harness its potential for one of the most critical: managing their money.

Today, I want to dive into five practical ways you can start leveraging AI to elevate your financial and investing decisions.

I’ll cover:

How to create financial dashboards so you can identify trends with your spending/investing

How you can automate investing research 📈

How you can use AI to optimize your investment strategy

How to cut back on unnecessary subscriptions using AI 💰

How AI can help identify tax-saving strategies

Let’s jump in!

More: Subscribe on YouTube for more explainers | Follow on Substack Notes | 🔒Upgrade to Finbrain Pro

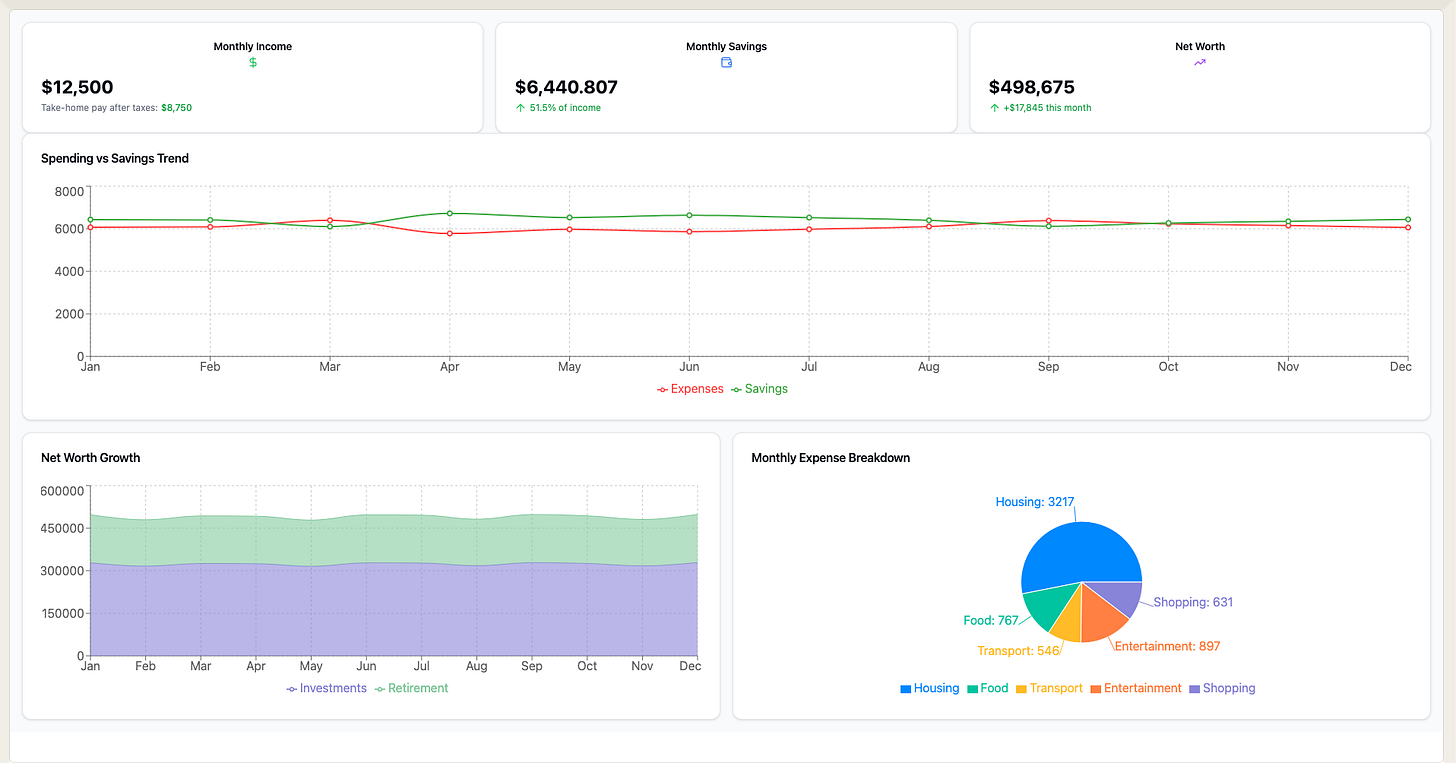

1. Create financial dashboards with Claude Artifacts so you can identify trends with your spending and investing

Managing your finances can feel like a mess of spreadsheets and numbers.

Claude Artifacts can makes it simple. If you’ve not heard of Claude or Artifacts before, think of it as ChatGPT but with the ability to create mini apps that you can use for all sorts of things.

From a finance perspective, it helps you create custom dashboards to track spending, investments, and savings all in one place.

How to guide

First, export your financial data from your bank/brokers/credit card companies as CSV files. The more data you can feed it, the more powerful the results.

Once you’ve got your spreadsheet of financial data, ask Claude to create an Artifact dashboard component with these key features:

Monthly income vs. expenses chart

Net worth tracker over time

Investment portfolio allocation pie chart

Spending category breakdown

Plus, anything else you’d like e.g. credit card spend trend line

Example Prompt:

Create a financial dashboard artifact using all the attached data, including bank statements, credit card statements, mortgage statements, and investments

On the dashboard, I'd like to be able to see my monthly income vs. expenses, net worth over time, a breakdown of my investment portfolio, and easily identify key spending categories.With the first draft of your Artifact created, you can then ask Claude to add interactive elements to it like:

Date range selectors to filter data

Toggles to show/hide different metrics

Hover states for detailed information

The key here is to iterate with Claude to add custom metrics important to you and it’s always best to anonymise any super sensitive information that you don’t want shared with AI tools.

2. Use Perplexity for Investment Research

Researching stocks can be incredibly tedious and time-consuming, requiring hours of digging through financial reports, analyzing market trends, and comparing data points. It’s no surprise that many people either avoid it altogether or miss out on opportunities because they don’t have the time or patience to dive in.

This is where AI is a potential game-changer, by automating the heavy lifting - like analyzing data, spotting trends, and delivering insights quickly to help you make more informed decisions.

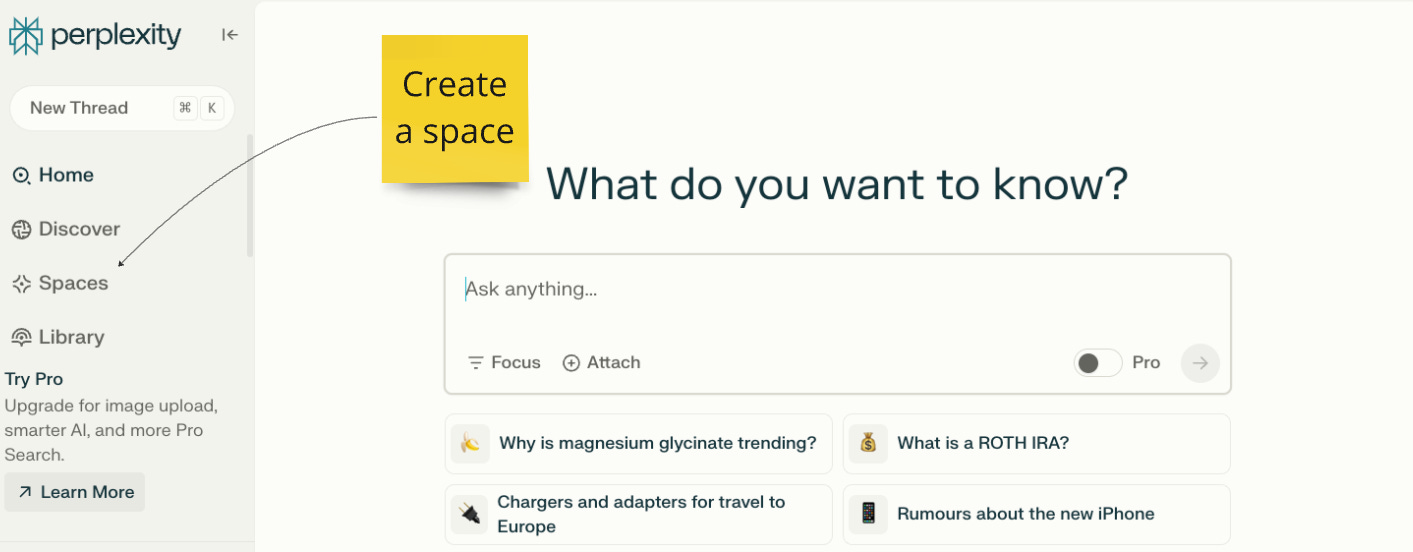

To illustrate this, I want to use Perplexity, who’ve recently launched their own finance features to show you how you can make investment research A LOT easier!

How to guide:

Step 1: Create a dedicated research space in Perplexity for investments. Spaces are essentially dedicated areas where you can group your research based on themes - ideal for managing financial / investment research.

Step 2: Set custom instructions like:

"Focus on quantitative data and historical performance"

"Prioritize official financial sources and established analysis"

Step 3: Build research collections for different topics:

Individual stocks you're tracking

Market sectors of interest

Economic indicators

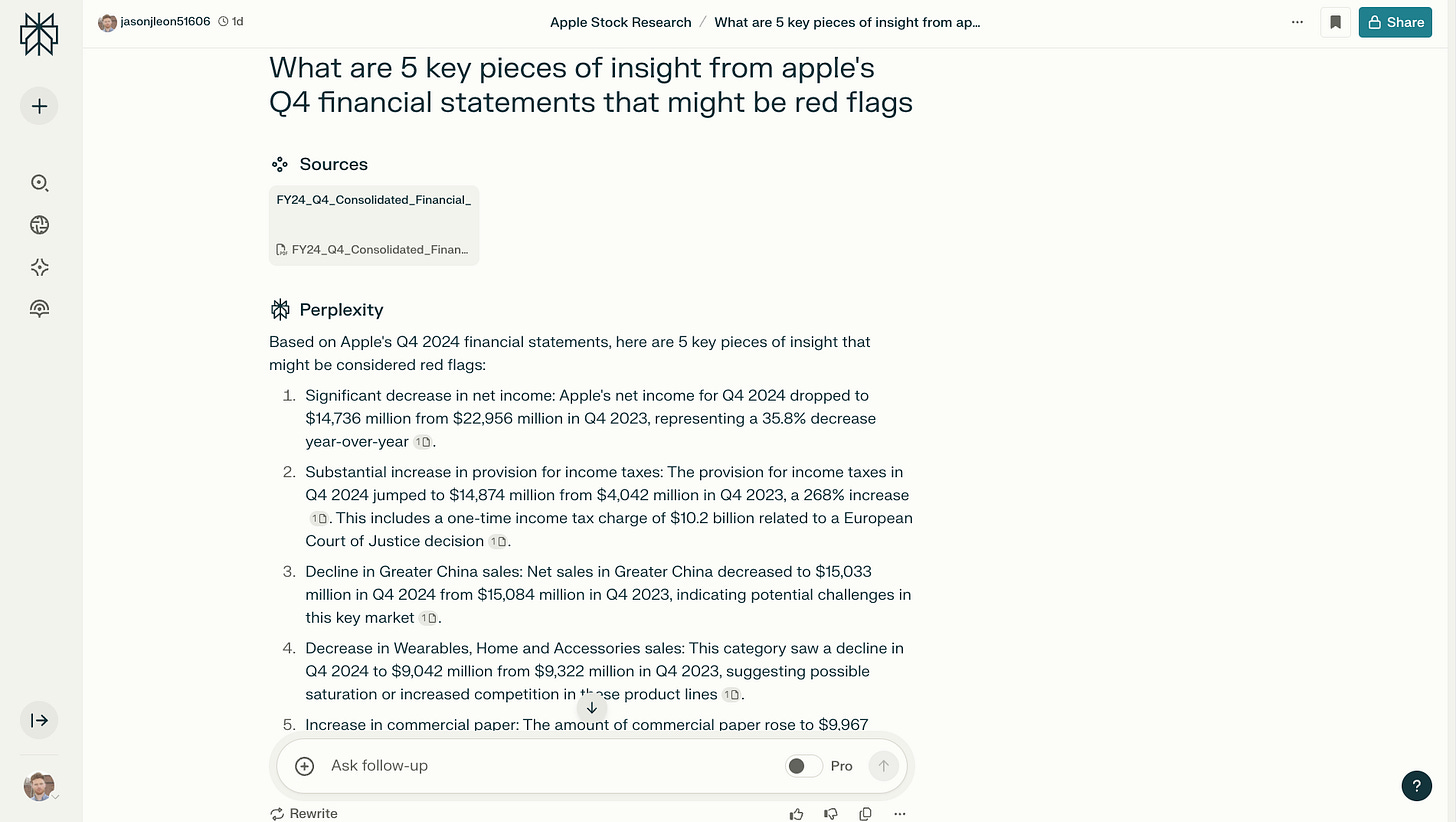

Step 4: Use the multi-source analysis to compare different viewpoints e.g. I uploaded Apple’s Q4 financial statements and gave this prompt:

What are 5 key pieces of insight from Apple's Q4 financial statements that might be red flagsAnd this is Perplexity’s response - impressive, right?!

Once you’ve finished your research you can then save and organize key findings for future reference. That way you’ll also be able to ask Perplexity what are the key differences from previous findings. It’s like having your own personal financial analyst to help you make investment decisions.

3. Optimize your investment strategies using ChatGPT

I've been investing for a long time now and I still get a lot out of using ChatGPT, analyzing my portfolio and approach being one of my favorites.

How to guide:

Step 1: Input Your Profile and Goals

Start by providing ChatGPT with a detailed overview of your financial profile. This could include:

Risk tolerance: Are you conservative, moderate, or aggressive? If you don’t know, ask ChatGPT to give you a quick quiz to find out:

Give me a short but useful quiz which would help me understand my investing risk tolerance levelsInvestment goals: Are you saving for retirement, building a down payment, or creating passive income?

Time horizon: How long do you plan to invest before needing the funds?

Current assets: Describe your existing portfolio - stocks, bonds, real estate, or alternatives.

Preferences: Specify industries, ethical considerations and asset classes you prefer or definitely don’t want

Personality type: you could add that you’re more logical vs emotional for example and you don’t tend to rush decisions

For instance, you could say:

I'm 35, looking to invest aggressively for retirement in 30 years. I have a $150,000 portfolio split between stock and bonds, and I'm in interested in technology, REITs and healthcare. I can tolerate high volatility in exchange for higher returns.Step 2: Tailored Strategy Suggestions

ChatGPT will use your inputs to suggest a tailored investment strategy. For example:

Growth Investing: Based on your risk tolerance and long time horizon, GPT might recommend focusing on high-growth sectors like technology, clean energy, or biotech, emphasizing small-cap stocks and emerging markets for higher potential returns.

Rebalancing Plan: GPT could outline a plan to review and rebalance your portfolio annually to maintain your 70/30 allocation, ensuring that your risk stays aligned with your goals.

Alternative Investments: If your preferences include diversification, GPT might suggest adding a 10% allocation to REITs or private equity for additional growth potential and inflation hedging.

You could also explore deeper strategies by asking follow-up questions like,

“What’s the best way to hedge against inflation in this portfolio?” or “How should I adjust if there’s a prolonged market downturn?”

Step 3: Scenario Planning and Dynamic Adjustments

After defining a baseline strategy, you can use GPT to simulate how your portfolio might perform under different market scenarios. For example, you might ask:

“What happens if interest rates rise by 2% over the next three years?”

“How does a recession impact small-cap growth stocks in the technology sector?”

GPT can analyze these scenarios and recommend changes, such as increasing exposure to defensive sectors (like utilities) or suggesting a temporary shift to cash or short-term bonds.

Step 4: Behavioral Insights

Finally, ChatGPT can act as your personal financial coach, identifying emotional biases that could derail your strategy. For instance, if you have a tendency to sell during market dips, GPT might build safeguards into your strategy, such as emphasizing long-term index funds or automating contributions to avoid emotional decision-making.

Remember: AI tools can hallucinate and don’t always get things right so it’s always best to double check any outputs from verified sources.

4. Use AskTrim to analyze your subscriptions and negotiate better deals

If you were to scan all your credit card and debit card statements, you would probably find at least one subscription you aren’t using.

But thankfully, thanks to AI, we don't have to rely on our minds to remind us that a) they're still there, and b) they need to be canceled.

There’s lots of tools out there for this, but the one I like is AskTrim.

AskTrim uses AI to track your spending and find subscriptions you might have forgotten about - like a gym membership you haven’t used in months or that streaming service you barely watch. Once it spots these, it’ll let you know (via text, FB message etc) so you can cancel them and put that money back into your pocket.

AskTrim can actually negotiate your bills for you too - think internet, cable, insurance, you name it. It’ll reach out to your service providers to see if it can score you a better deal. No more haggling with customer service. It's all automated, which saves you time and keeps things simple.

Here’s how it works:

First, you sign up and connect AskTrim to your bank account.

It scans your transactions to spot any recurring charges or subscriptions.

AskTrim will then help you cancel any unused services and negotiate lower bills on your behalf.

On top of that, it’ll offer personalized tips on how to save based on your spending habits.

5. Identify tax saving tactics

Taxes are a necessary evil that eat up our time, and let’s be honest - most of us aren’t confident we’re using all the tax-saving strategies out there. Worse, we’re not sure our accountants are either 😬.

So you can use Perplexity for this one or Claude.

How to guide:

Input Financial Data: Provide Perplexity/Claude with detailed information about your financial situation, including income, expenses, investments, and past tax returns.

Then enter some solid prompts, here’s a few to get you started:

Prompt 1 - general and up-to-date tax optimization tips:

Develop a tax optimization strategy that leverages current tax laws and regulations to minimize tax liabilities for individuals (then insert your relevant details)Prompt 2 - estate and inheritance tax optimization tips:

Analyze tax planning opportunities for estate and inheritance tax purposes. Provide recommendations on how to structure assets to minimize tax obligations for future generations (insert the estate details)Prompt 3 - investment/diversification focus

Evaluate tax-efficient investment options to maximize returns and minimize tax liabilities. Recommend a diversified portfolio strategy that aligns with long-term financial goals: (insert investment details)Prompt 4 - identifying where you can get tax deductions

Conduct a comprehensive analysis of tax credits and deductions available for specific industries or sectors. Identify opportunities to optimize tax planning strategies and maximize savings: (insert industry details)This is a straightforward example, but let’s say you’re 🇺🇸 based, you work in tech and you mainly invest in the S&P 500, then here’s a view of what you should be looking out for to be savvy with saving on tax:

I mean, I’m just scratching the surface with the possibilities that AI gives us with managing our finances, but I hope this has got you thinking.

Thanks and have a great week ahead!

Jason

More: Subscribe on YouTube for more explainers | Follow on Substack Notes | Upgrade to Finbrain Pro

DISCLAIMER: None of this is financial advice. The Finbrain newsletter is strictly for educational purposes. AI tools can hallucinate and are not a replacement for financial advice.

Incredible amounts of thoughtful and researched advice. Your hook read me like a book - I hadn’t thought to use AI for personal finance. Thanks for sharing!

Thanks for sharing this—it’s super helpful! I’ve been using Google Looker Studio linked to Google Sheets for creating dashboards, and it’s been great so far. I haven’t tried Claude Artifact yet, but you’ve definitely piqued my interest! I’ll check it out to see if it’s a better fit for my financial dashboards. By the way, here’s few snippets that I shared from my dashboard https://vittainsight.substack.com/p/s-and-p-stumbles-to-the-finish-line Would love to hear your thoughts!